Custom Private Equity Asset Managers Things To Know Before You Get This

Custom Private Equity Asset Managers Things To Know Before You Get This

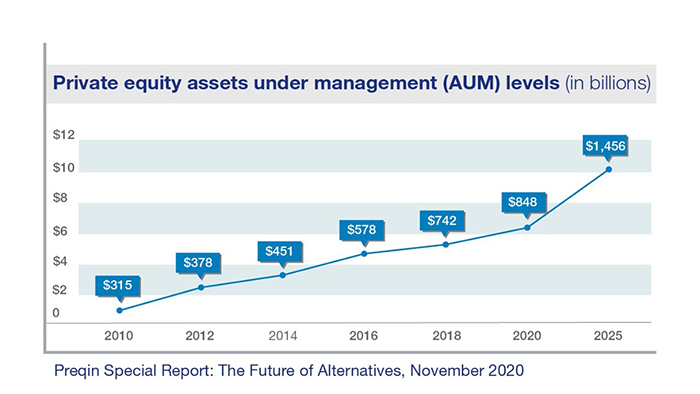

(PE): investing in firms that are not openly traded. Approximately $11 (https://madgestiger79601.wixsite.com/cpequityamtx/post/unlocking-prosperity-tx-trusted-private-equity-company-and-private-asset-managers-in-texas). There might be a couple of things you don't understand concerning the market.

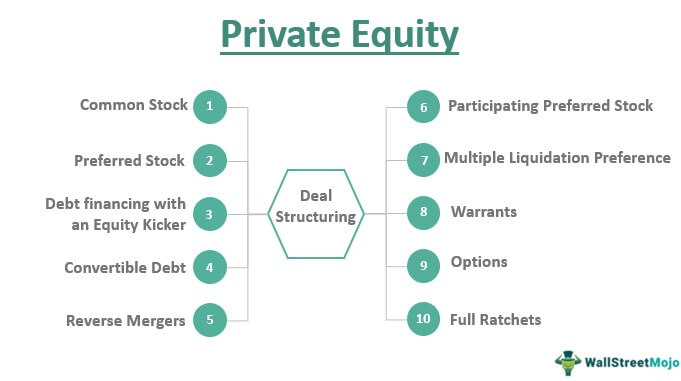

Companions at PE companies raise funds and take care of the cash to produce beneficial returns for shareholders, commonly with an financial investment perspective of between 4 and seven years. Exclusive equity companies have a series of financial investment choices. Some are rigorous financiers or passive investors wholly reliant hop over to these guys on administration to expand the firm and produce returns.

Since the very best gravitate towards the bigger deals, the center market is a substantially underserved market. There are extra vendors than there are extremely seasoned and well-positioned financing professionals with substantial purchaser networks and sources to handle an offer. The returns of exclusive equity are commonly seen after a few years.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

Flying below the radar of huge multinational corporations, most of these small companies frequently provide higher-quality client service and/or niche services and products that are not being provided by the large empires (https://worldcosplay.net/member/1673310). Such upsides draw in the rate of interest of private equity firms, as they have the understandings and smart to make use of such possibilities and take the company to the next level

The majority of managers at profile firms are given equity and incentive settlement structures that award them for hitting their economic targets. Private equity opportunities are frequently out of reach for individuals who can not spend millions of dollars, yet they should not be.

There are laws, such as limits on the aggregate amount of cash and on the number of non-accredited financiers (Private Investment Opportunities).

A Biased View of Custom Private Equity Asset Managers

Another disadvantage is the absence of liquidity; once in a private equity purchase, it is difficult to leave or offer. There is an absence of versatility. Private equity also comes with high charges. With funds under management currently in the trillions, personal equity companies have become eye-catching investment lorries for affluent individuals and institutions.

Currently that access to personal equity is opening up to even more private financiers, the untapped potential is coming to be a truth. We'll start with the primary disagreements for spending in personal equity: Just how and why exclusive equity returns have actually traditionally been higher than other possessions on a number of levels, How including private equity in a portfolio affects the risk-return account, by aiding to expand versus market and intermittent risk, After that, we will certainly describe some crucial factors to consider and dangers for exclusive equity capitalists.

When it comes to presenting a new asset right into a portfolio, the many fundamental consideration is the risk-return profile of that property. Historically, exclusive equity has actually exhibited returns comparable to that of Arising Market Equities and greater than all other traditional possession classes. Its reasonably low volatility combined with its high returns makes for an engaging risk-return account.

The Best Guide To Custom Private Equity Asset Managers

Actually, exclusive equity fund quartiles have the widest array of returns across all alternative possession classes - as you can see listed below. Approach: Inner price of return (IRR) spreads determined for funds within classic years separately and after that averaged out. Typical IRR was calculated bytaking the average of the average IRR for funds within each vintage year.

The result of adding private equity into a profile is - as constantly - dependent on the portfolio itself. A Pantheon study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the most effective private equity firms have accessibility to an also bigger pool of unknown possibilities that do not face the exact same analysis, along with the resources to execute due persistance on them and identify which deserve buying (TX Trusted Private Equity Company). Spending at the very beginning means higher danger, however for the business that do prosper, the fund take advantage of greater returns

Rumored Buzz on Custom Private Equity Asset Managers

Both public and personal equity fund supervisors dedicate to spending a percent of the fund yet there continues to be a well-trodden concern with aligning interests for public equity fund management: the 'principal-agent issue'. When an investor (the 'principal') employs a public fund supervisor to take control of their funding (as an 'representative') they pass on control to the supervisor while retaining possession of the possessions.

In the instance of exclusive equity, the General Partner doesn't just earn a management cost. Exclusive equity funds additionally alleviate one more form of principal-agent problem.

A public equity investor inevitably wants one point - for the monitoring to boost the stock rate and/or pay returns. The investor has little to no control over the choice. We revealed above the number of personal equity methods - specifically majority acquistions - take control of the running of the company, ensuring that the lasting value of the company comes initially, pushing up the return on investment over the life of the fund.